Key Takeaways

Multifaceted Causes of Decline: The significant downturn in CRE investment volume is not the result of a singular issue but a complex interplay of global economic factors, changing investor sentiment, and market dynamics. Understanding these causes is crucial for developing effective strategies to navigate the current market.

Risk Management is Key: With lower investment volumes come increased risks, including reduced liquidity and potential depreciation in property values. Investors must prioritize risk assessment and management in their strategies, adapting to the market’s evolving nature to protect and grow their investments.

Opportunities Exist Even in Downturns: Despite the challenges, downturns can uncover unique investment opportunities, such as acquiring undervalued assets or exploring emerging market segments. Investors with a keen eye for such opportunities and the courage to act may find themselves well-positioned for gains in the market’s recovery phase.

The Importance of Data-Driven Decisions: Leveraging data and analytics is more important than ever in making informed investment decisions. Access to up-to-date market data, trend analysis, and predictive modeling can provide a competitive edge, enabling investors to identify trends and opportunities that others may overlook.

Adaptability and Long-Term Planning: Success in navigating the current CRE market downturn requires adaptability and a focus on long-term planning. Investors should be prepared to adjust their strategies in response to market changes and focus on long-term objectives rather than short-term gains. This approach can help mitigate immediate risks while positioning for future growth.

Introduction

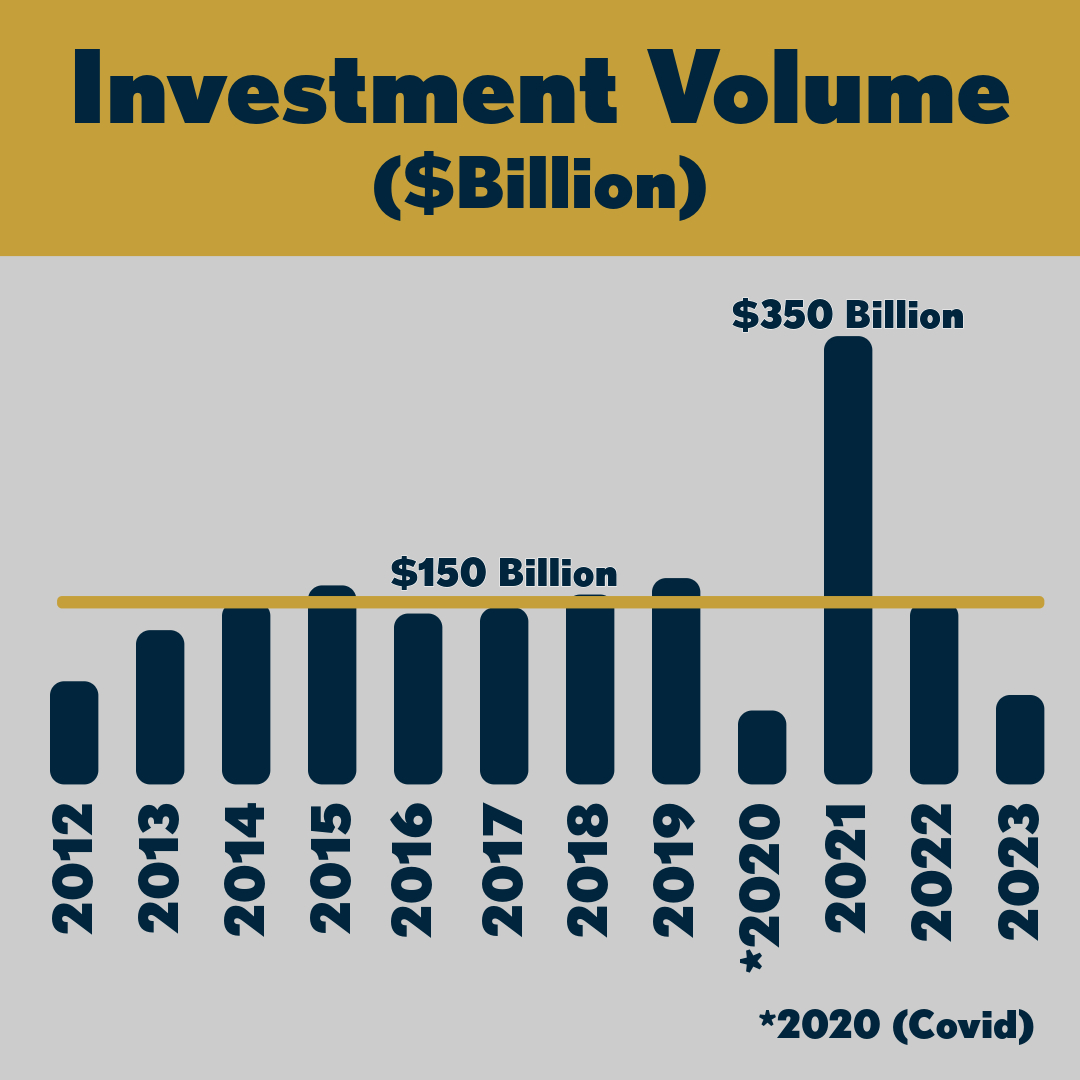

Commercial real estate (CRE) investment volume fell to its lowest level in over a decade. This downturn has sent ripples across the industry, prompting investors, analysts, and stakeholders to reevaluate their strategies and expectations for the future. This article explores the factors contributing to this decline, the risks and opportunities it presents, and practical advice for navigating these turbulent waters.

Understanding the Decline

The decline in CRE investment volume isn’t attributable to a single factor but rather a confluence of global economic pressures, shifting investor sentiments, and evolving market dynamics. From rising interest rates and geopolitical tensions to changes in consumer behavior post-pandemic, we explore how these elements have intertwined to create the current market scenario.

Risks Associated with Lower Investment Volumes

Lower investment volumes bring about a host of risks for the CRE market, including decreased liquidity, potential declines in property values, and heightened uncertainty among investors. We dissect these risks, providing a detailed look at their implications for both short-term trading and long-term investment strategies.

Opportunities Amidst the Downturn

Yet, within every challenge lies opportunity. This section highlights how savvy investors can turn the downturn to their advantage. From acquiring undervalued properties to diversifying portfolios in non-traditional CRE sectors, we outline strategies that can pave the way for substantial gains when the market rebounds.

The Role of Data and Analysis in Making Investment Decisions

In the age of information, data is king. We emphasize the importance of leveraging market data, investment volume trends, and predictive analytics in crafting informed, strategic investment decisions. This section also introduces readers to key tools and resources for data analysis.

The current downturn in CRE investment volume presents a complex blend of challenges and opportunities. By understanding the underlying factors, assessing risks accurately, and seizing the right opportunities, investors can navigate this uncertain landscape with confidence. As we move forward, staying informed and agile will be paramount. The landscape of commercial real estate is inherently dynamic, subject to the ebb and flow of economic cycles, regulatory changes, and evolving investment trends. Embracing a mindset of continuous learning and adaptation will not only help investors mitigate risks but also capitalize on the windows of opportunity that invariably arise in times of change.

The downturn in CRE investment volume is a reminder of the market’s vulnerability to wider economic forces and the importance of strategic flexibility. Investors who take the time to delve deep into the causes of the current downturn, who apply analytical rigor to their decision-making, and who approach the market with a blend of caution and optimism, are the ones most likely to thrive.

In the face of uncertainty, the value of community and shared wisdom cannot be overstated. Engaging with fellow investors, leveraging expert insights, and participating in industry discussions will enrich your understanding and decision-making capacity. The challenges of today’s CRE market are significant, yet within them lie the seeds of tomorrow’s successes. By fostering a culture of collaboration, openness to new ideas, and resilience in the face of adversity, we can all contribute to a more robust and vibrant real estate investment landscape.

As we move forward, let us not lose sight of the lessons learned during this downturn. The principles of thorough market analysis, risk assessment, and strategic flexibility are timeless guides that will serve investors well, regardless of market conditions. The current downturn is not just a challenge to be overcome but an opportunity to refine our approaches, strengthen our portfolios, and prepare for the vibrant market recoveries that history shows us are not a matter of if, but when.

In conclusion, the downturn in CRE investment volume marks a critical moment for introspection and strategic recalibration. By embracing the complex blend of challenges and opportunities it presents, investors can forge paths through the uncertainty with a blend of caution, creativity, and confidence. The future of commercial real estate investment is still bright for those prepared to navigate its complexities with insight, adaptability, and a forward-looking perspective.