Key Takeaways

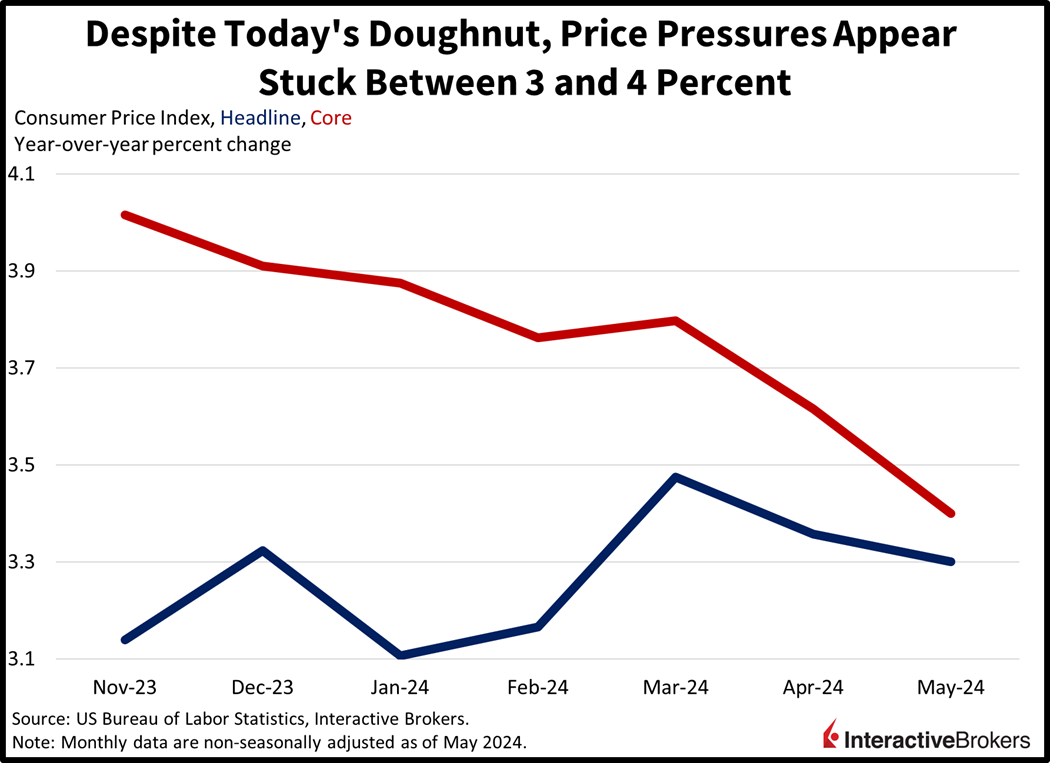

Moderation in Inflation Rates: The latest US CPI data showed a year-over-year increase of 3.3%, slightly below expectations, indicating a moderation in inflation rates. However, the markets may be underestimating the inflationary pressures due to a concurrent rise in average hourly earnings.

Market Reaction: The initial response to the CPI report was positive, leading to a rally in equity markets. However, subsequent data and statements from the Fed introduced uncertainty, particularly regarding future interest rate hikes.

Disinflation vs. Deflation: It’s paramount to understand the difference between disinflation, which is a reduction in the rate of inflation, and deflation, which is a fall in overall price levels. Disinflation indicates an economy that is potentially stabilizing, whereas deflation typically points to economic trouble.

Federal Reserve’s Stance: Fed Chair Jerome Powell emphasized the persistence of wage pressures and the necessity of managing inflation without hampering economic growth. This indicates a continued cautious approach towards monetary policy.

Investor Sentiment: Investors are adjusting their strategies in response to the Fed’s indications, showing a preference for high cash flow companies and those with lower borrowing costs due to expectations of prolonged higher interest rates.

Outlook: The challenge facing the Federal Reserve in balancing inflation control and economic growth. Future data and Fed communications will be critical in shaping market expectations and investment strategies amidst this uncertainty.

Latest U.S. Consumer Price Index:

On June 12th, the latest US CPI data showed a year-over-year increase of 3.3%, slightly below the expected 3.4%. This modest beat reassured markets that inflation isn’t accelerating, with the month-over-month headline inflation flat at 0%. Treasury yields reacted by dropping, and the futures market adjusted its expectations for 2024 easing, now pricing in over 50 basis points according to the CME Fed Watch tool.

However, beneath the surface lies a critical nuance: the markets overlooked a 0.8% year-over-year rise in average hourly earnings—a subtle indicator of underlying wage pressures. While equity markets rallied, with the S&P 500 climbing over 1%, the Federal Reserve’s path to easing remains uncertain, with the possibility of a September rate hike still on the table. Market consensus on the likelihood of a rate hike shifted dramatically after the FOMC’s remarks, highlighting the prevailing uncertainty.

Disinflation vs. Deflation: A Critical Distinction

Understanding the distinction between disinflation and deflation is paramount. Disinflation refers to a slowdown in the rate of inflation—prices are still rising, but at a slower pace. It’s akin to reducing the speed of a car but not stopping it. In contrast, deflation is when prices actually fall, akin to putting the car in reverse. This difference is crucial because while disinflation can indicate a stabilizing economy, deflation often signals economic trouble, leading to reduced consumer spending and potential recessions.

The “Doughnut CPI” report—so named for the flat month-over-month inflation—brought initial cheers from investors, suggesting a potential soft landing. But the subsequent PPI report showed a more troubling sign: possible deflation, with headline PPI falling by -0.2%. Disinflation is manageable and can be a sign of a cooling but healthy economy. Deflation, however, can lead to a vicious cycle of reduced spending and further economic decline, making it a more severe concern.

Pressures on Consumers:

Fed Chair Jerome Powell’s recent remarks highlighted the persistent wage pressures that need to be addressed to meet the 2% inflation target. Powell’s tone was cautious, emphasizing the need for further progress and the potential for additional rate hikes if inflationary pressures do not ease. This cautious approach reflects the Fed’s delicate balancing act—managing inflation without stifling economic growth.

Investor Expectations:

Investors, hoping for a dovish pivot from the Fed, found Powell’s stance more pragmatic. High cash flow companies and those with lower borrowing costs have become more attractive, reflecting a strategic shift in response to prolonged higher rates. Market reactions have been volatile, with significant fluctuations in expectations following each new data release and Fed statement.

Conclusion:

As we move forward, the Federal Reserve’s challenge remains formidable. Balancing the dual mandates of controlling inflation and supporting economic growth is no small feat. Upcoming data releases and Fed communications will be pivotal in shaping market expectations and investment strategies. The road ahead is fraught with uncertainty, but one thing is clear: the Fed’s careful navigation will be crucial in steering the economy through these turbulent times.