Rethinking the Fed's Role in Preventing Financial Storms

• Fed’s Mandate must expand to include asset value stability

• Low-interest rates and asset purchases – potential risks associated with overly accommodative monetary policies

• The Real Estate Case Study: how accommodative policies can impact asset values and potentially lead to asset bubbles

• Expanding the Fed’s mandate to prevent asset bubbles could have mitigated the housing market boom during the pandemic

• The Role of Interest Rates in preventing asset bubbles and their associated risks

Expanding the Fed’s Mandate

The FED’s mandate should be expanded. Apart from maximum employment and controlled inflation, it must include asset VALUE stability. This would prevent the FED from being overly accommodative on rates and on the purchase of assets on their balance sheet. In other words, to have data inform the Fed where exactly the money is not needed.

Alternatively, with asset value stability in mind, in an instance of emergency intervention such as the 9/11 attack, the initial cuts could be dialed back in a more nuanced manner. This would replace pouring liquidity and cheap money into every crevice of the economy.

Risks of Ultra-Accommodative Monetary Policies

Imagine if during the pandemic the FED acknowledged the steep run-up in apartment building value.

If it reacted by dialing back Fannie and Freddie loan proceeds, ceased buying MBS, and advised or banned their bank members from doing so as well.

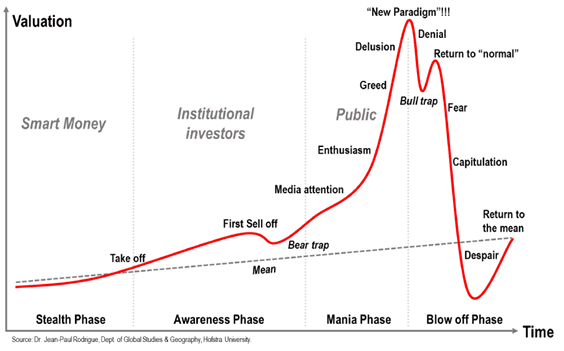

The boom-bust may been moderated to a swell and subsidence back to the long-term mean.

This would have left the deficit lower as the Fed is borrowing money to pay for their acquisitions via Treasury Bill sales.

The bank meltdown of 2023 revealed the FED and many of their member banks acquired trillions of dollars in long-dated mortgage-backed securities.

Of course, their reasons may vary. However, the prevailing write-ups I read indicated the purchases were made in a quest for yield, while the FED Funds Rate declined to 0 during the pandemic.

The Fed itself was purchasing with the intent of stabilizing what could have been a collapse in asset VALUE.

All of these investors (Banks buying loans), like any commodity that is highly sought after, increased the value of mortgage-backed securities. It stimulated the demand above the neutral level of investor interest.

More buyers obviously means sellers can raise prices.

This in turn means the loans can be at a lower interest rate and still sell to this new robust body of buyers. The easier it is to finance, the more the end user can and will pay for the underlying tangible asset which is collateral for the lender and loan buyer.

A Mandate to Avoid Asset Bubbles and The Role of Interest Rates

Home builders and resellers are experts in making homes more luxurious and more expensive as the market bears it.

With mortgage rates under 3%, buying power was nearly unprecedented, leading to a run on home prices.

This so-called asset bubble is a huge and avoidable risk to the financial markets as well as the net worth of the country. It would take years if not decades for buyers to accumulate the cash they need to acquire the same home they wanted when rates were 3% versus 7%.

If the Fed’s mandate had been expanded to include the prevention of asset VALUE bubbles, this may not have happened. They would have raised rates when tangible asset inflation accelerated or ceased mortgage-backed security purchases much earlier than they ultimately did.