Key Takeaways

Life Insurance Loans Basics: Policyholders can borrow against the cash value of their life insurance policies, providing a flexible and quick funding source without the need for extensive credit checks or traditional loan requirements.

Unique Advantages: These loans come with competitive interest rates, flexible repayment terms, and notable tax benefits such as no immediate tax on borrowed funds and potentially tax-free investment returns.

Potential Risks: Failure to repay the loan can reduce the policy’s cash value and lead to significant tax consequences, highlighting the importance of strategic financial planning and risk management.

Investment Opportunities: Borrowers can use these loans to invest in high-yield opportunities like real estate, stock markets, and alternative investments such as private equity or cryptocurrencies, allowing for portfolio diversification without liquidating existing assets.

Strategic Considerations: It’s essential to select the right policy with adequate cash value and favorable loan terms, understand all loan conditions, and develop a comprehensive risk management strategy to optimize financial outcomes and ensure one’s financial future stability.

Taiwan Semiconductor Manufacturing Co (TSMC), the global leader in semiconductor production, is set to manufacture its most advanced chips in Arizona. This move significantly boosts domestic manufacturing capabilities, particularly for chips that power artificial intelligence technologies.

Harnessing Life Insurance Loans for High-Yield Investments:

In today’s rapidly changing economic landscape, individuals constantly seek innovative strategies to secure their financial futures and unlock new pathways to prosperity. One such strategy gaining traction recently is utilizing life insurance loans for high-yield investments.

Understanding Life Insurance Loans:

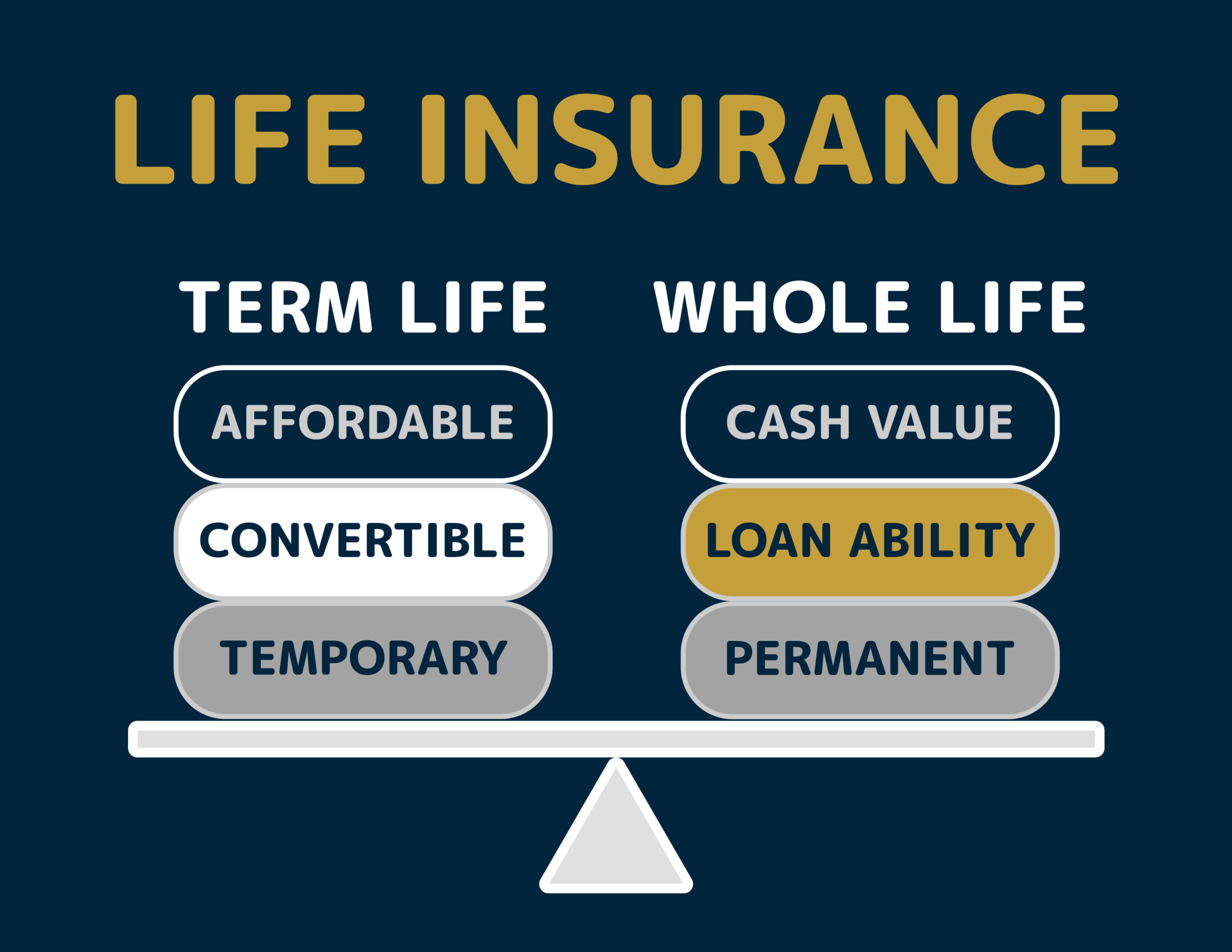

Life insurance loans, also known as policy loans, allow policyholders to borrow against the cash value of their life insurance policies. Unlike traditional loans from banks or financial institutions, life insurance loans offer unique advantages, including flexible repayment terms, competitive interest rates, and tax advantages.

One key benefit of life insurance loans is the ability to access funds quickly and conveniently without extensive credit checks or collateral. The cash value accumulated within a life insurance policy serves as collateral for the loan, providing a secure source of financing for various investment opportunities.

However, it’s essential to understand that life insurance loans are not without their risks. Failure to repay the loan promptly can result in the depletion of the policy’s cash value and potential tax consequences. Therefore, it’s crucial to approach life insurance borrowing carefully and clearly understand the associated terms and conditions.

The Benefits of Using Life Insurance Loans for Investments:

1. Leveraging Cash Value: By borrowing against the cash value of your life insurance policy, you can access funds to invest in opportunities that have the potential to generate high returns. This allows you to maximize your policy’s value while maintaining its death benefit for your beneficiaries.

2. Tax Advantages: Life insurance loans offer tax advantages that can help optimize your investment returns. Since the loan proceeds are not taxable, you can avoid immediate tax liabilities on the borrowed funds. Any gains generated from your investments may be tax-deferred or tax-free, depending on the investment vehicle.

3. Flexible Repayment Options: Unlike traditional loans, life insurance loans typically offer flexible repayment options. You can repay the loan on your own terms, allowing you to tailor your repayment schedule to align with your investment goals and cash flow.

4. Preservation of Assets: Borrowing against your life insurance policy allows you to access funds without liquidating other assets or investments. This can be particularly beneficial during market downturns or financial emergencies when selling assets may result in losses or disrupt long-term investment strategies.

High-Yield Investment Opportunities:

1. Real Estate Investments: Real estate has long been considered a lucrative investment opportunity, offering the potential for both rental income and property appreciation. By leveraging life insurance loans, you can invest in rental properties, fix-and-flip projects, or real estate investments to generate passive income and build long-term wealth.

2. Stock Market Investments: Investing in the stock market can provide significant returns over time, but it also comes with inherent risks. With life insurance loans, you can invest in a diversified portfolio of stocks, bonds, and mutual funds to capitalize on market opportunities and achieve your financial goals.

3. Alternative Investments: In addition to traditional investment vehicles, various alternative investment opportunities can offer high yields and diversification benefits. These may include peer-to-peer lending, private equity investments, venture capital funds, and cryptocurrency investments. You can access these alternative asset classes by leveraging life insurance loans and potentially enhancing your investment returns.

Best Practices and Considerations:

1. Selecting the Right Policy: Not all life insurance policies are created equal. Choosing a policy with sufficient cash value and favorable loan terms is essential to support your investment objectives.

2. Understanding Loan Terms: Take the time to carefully review the terms and conditions of the life insurance loan, including interest rates, repayment options, and potential penalties for non-payment.

3. Managing Risks: While life insurance loans offer potential benefits, they also come with risks. It’s important to assess your risk tolerance and develop a comprehensive risk management strategy to protect your investments and financial well-being.

Conclusion:

In conclusion, harnessing life insurance loans for high-yield investments can be a powerful strategy for achieving financial freedom and building long-term wealth. By leveraging the cash value of your life insurance policy, you can access funds to invest in opportunities that have the potential to generate significant returns while preserving your assets and minimizing tax liabilities.

As with any investment strategy, it’s essential to conduct thorough research, seek professional guidance, and carefully consider the risks and rewards before making any decisions. With careful planning and informed decision-making, you can leverage life insurance loans to create a solid foundation for financial success and unlock new possibilities for a brighter future.