Jason Buxbaum would say: “Nothing and everything at the same time”

One thing that can be important is the White Papers which are presented at JH, and this year one caught my attention, Barry Eichengreen’s “Living In A World of Higher Public Debt”.

Why does this matter to us, Real Estate Investors?

Well, it touches on two points that I think merit review:

Declining Prestige of the Treasury Bill

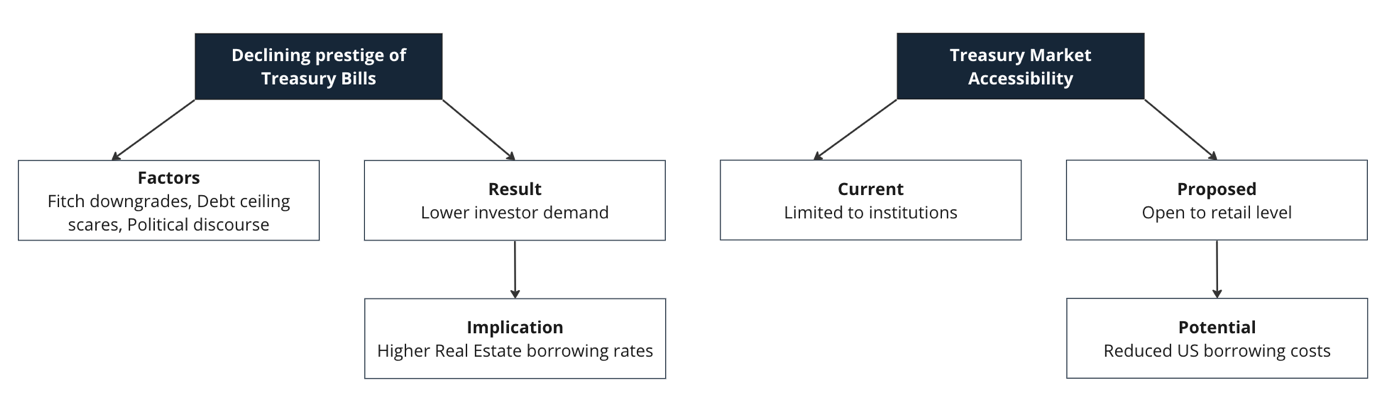

The first is indirect and not part of the article, and that is the declining prestige and utility of the Treasury Bill in the global markets. This is related to two important points the article shines a light on. The US does not have a political consensus such that it could decrease spending enough to outpace the growth rate of servicing the debt. Both political parties like to spend, and it takes a consensus to make meaningful cuts.

Shift in Perception of the Treasury’s Risk

Negative real GDP created by a nation running below debt service coverage 1.0 poses a risk that spoils the whole concept of a “Risk-Free” investment. This is what the TBill is usually labeled as. The treasury may be the single most important index from which multifamily residential property is valued at since the debt Fannie Mae and Freddie Mac issue is explicitly guaranteed by the good faith and credit of the United States. I like to call it a “T-Bill with a kicker”.

Did I find any good news in this article?

As a child, I recall my Dad showing me a drawer full of physical US Treasury notes gifted to him by his parents at some point. According to Treasurydirect.gov, there are only two types of savings bonds offered which are not the same as trading securities like a stock.

Currently, Treasury Trading is for large institutions and their upper-tier clients, far from “Main Street”. I can only imagine with all the distrust of banks how many Americans would like to have easy access to this market, and I would think this new infusion of buyers would drive down US borrowing costs significantly.