Key Takeaways

- Challenges in Quantifying Supply and Demand: Supply and demand are fundamental but difficult to accurately quantify due to availability of good data.

- In-depth In-house Broker Research: The complete perspective is reserved exclusively for local, reputable Broker research teams who dedicate their in-house resources to collect and consolidate the data.

- Phoenix Market Correction Has Started: Broker research projects a Soft Market for 2024 & 2025 with above-average vacancy and low rent growth.

- Austin Market Softening: A sizable supply of units will be delivered in 2024 but an economic slowdown driven by reduced jobs is weakening the market.

- Investment Opportunities in Phoenix & Austin: In 2024, a surplus of supply will lead to increased vacancy rate and decrease in rent growth.

- Historical Comparisons: Both Phoenix and Austin have the highest vacancy since 2011 which presents the best buying opportunity since then.

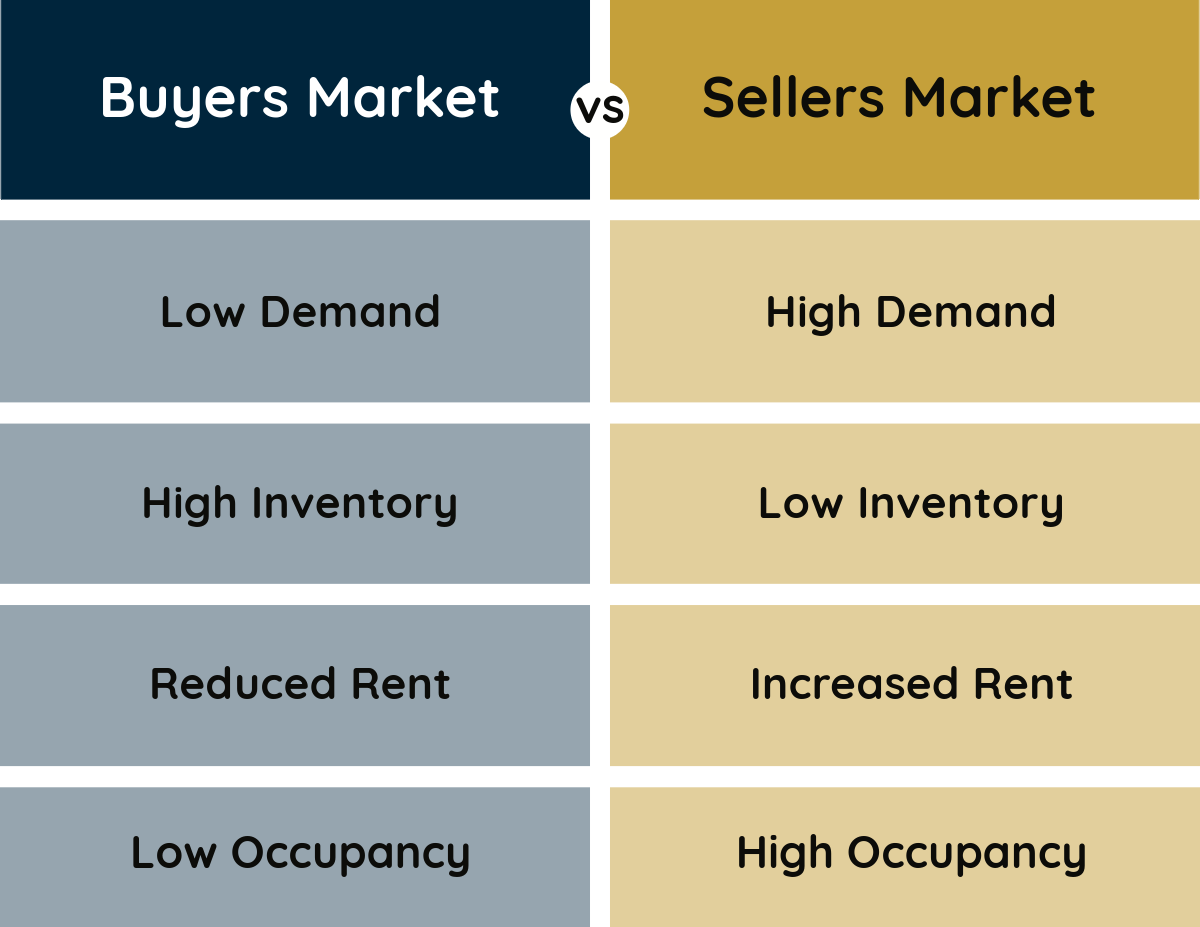

Supply and demand, the timeless forces guiding our economic landscape, can be quite challenging to accurately quantify. On the surface, it might seem straightforward to count the number of people moving to a city and the apartments they’re renting, but in reality, it’s far from simple. The big question is: where does the data come from?

When you apply to rent an apartment, there’s no checkbox indicating when you moved to a specific location. Therefore, this crucial piece of information remains elusive. Some statisticians suggest looking at the issuance of new driver’s licenses, which makes sense. However, personal habits, like holding onto a driver’s license for an extra year, can skew this data. So, what can we really determine? At best, we can identify how many more units are occupied today compared to yesterday. But even this can be challenging to pinpoint because landlords aren’t required to report this information. Consequently, data providers often resort to the traditional method of making phone calls.

That’s why I turned to one of my trusted brokers with an “in-house” research team. They meticulously verify the development status of every apartment complex with 100 units or more under construction. According to their pristine data, it appears that Phoenix’s housing market is in for softening in 2024, likely extending into 2025. The correction is already underway, with Phoenix expected to experience higher-than-normal vacancy rates and potentially even negative rent growth over the next 30 months.

Now, can investors see this coming? The answer is a bit complicated. When the pandemic struck, many construction projects were put on hold, delayed, or even canceled. This disrupted the usual prediction of project timelines based on groundbreaking dates. In 2021, Phoenix managed to deliver around 9,000 apartment units. By the end of the year, there were 14,000 more occupied units than in 2020, which indicates positive absorption, leading to low vacancy rates and rent growth.

Fast forward to late 2022, and the construction industry had recovered from its COVID-19-related setbacks. Not only were new projects on track, but all the previously delayed ones were also nearing completion.

Here are some key figures to consider:

- Phoenix is projected to deliver a whopping 26,744 apartment units in 2024.

- Fannie Mae anticipates Phoenix will only absorb 10,000 of these units, leaving a surplus of 16,000.

- Phoenix’s vacancy rate, according to Fannie Mae, stands at 8.25% in the middle of the year, the highest since 2011.

- In Austin, Texas, and its surrounding suburbs, 25,650 apartment units are expected to be delivered in 2024.

- Fannie Mae doesn’t provide an absorption projection for Austin, but it notes that the local economy has slowed due to tech layoffs and a shrinking government, which has affected the capital.

- Austin’s vacancy rate is at 7.75%, also the highest since 2011.

In summary, if you’re considering investing in robust markets like Phoenix & Austin, now might be the opportune moment. Just imagine the potential if you had purchased thousands of units back in 2011!