A Gradual Successful Series of Rate Decreases Would Warm Markets

Key Takeaways

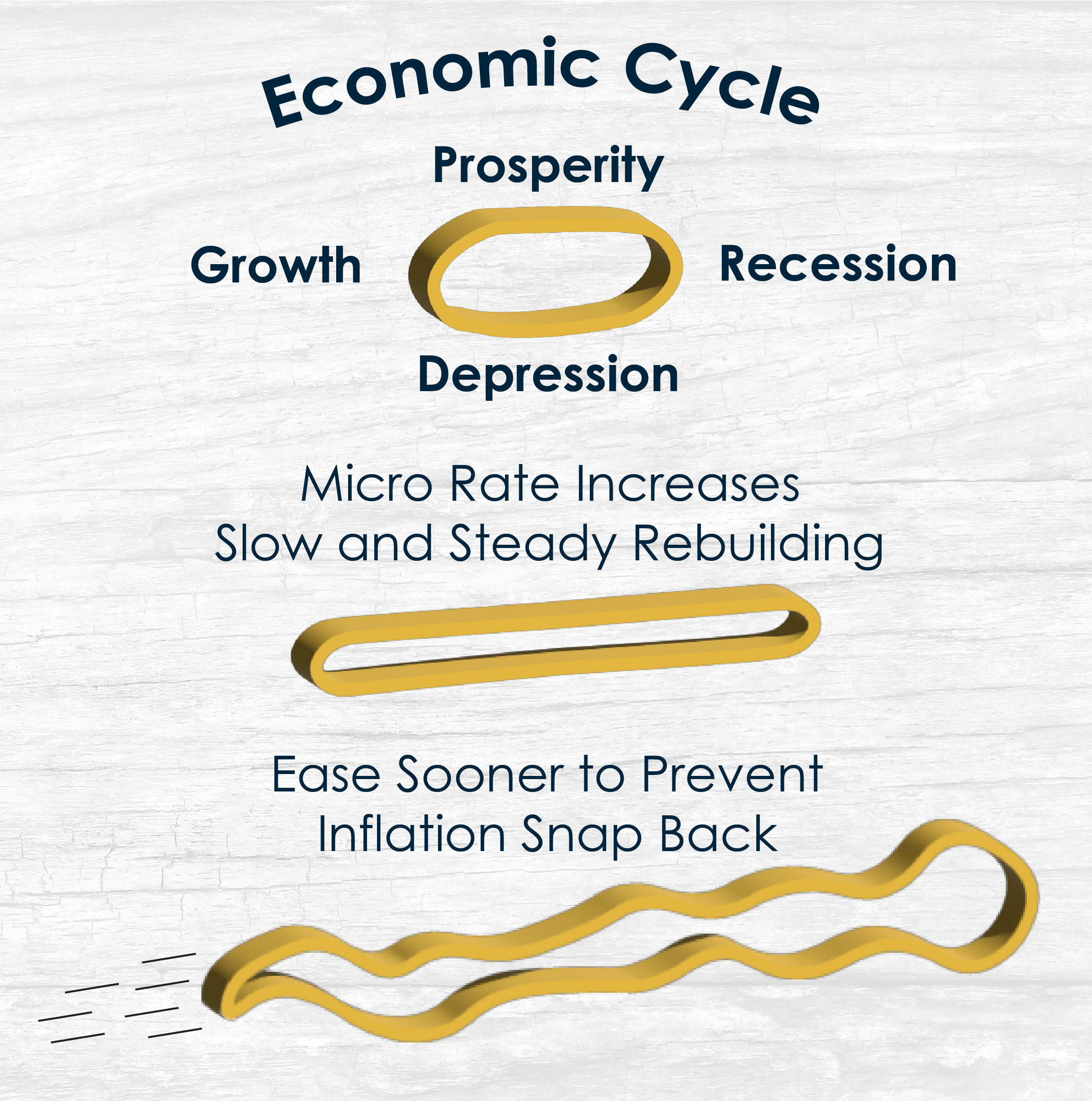

- Rubber Band Analogy:

Illustrates how the economy moves through periods of growth, slowdowns, and recovery.

- Worries about Tightening Measures:

The current Fed actions, like rate hikes and asset sales, could strain the economy, raising inflation risks.

- Interest Rates’ Impact on Consumer Behavior:

Higher rates, as observed in vehicle purchases, are deterring buyers and extending the vehicle replacement cycle.

- Policy Flexibility:

To stimulate the markets, it’s crucial for the Fed to implement Micro decreases in rates of 1/8th of one percent, with the option to reverse course at anytime if needed, to manage economic fluctuations more effectively.

- Balancing Act of the Fed:

The challenge lies in the Fed’s ability to gauge the right timing and extent of policy changes to support economic growth without overheating the economy or triggering excessive inflation.

Rubber Band Economics:

The risk of inflation snap back grows with every day the Fed does not start easing in very small increments. Picture a rubber band as a metaphor for our economy. It’s round with flat sides, representing economic cycles. The cycle starts at the edge of a flat side, marking times of steady growth. Then, a curve downward—perhaps due to a crisis like a war or a pandemic—slows things down. Next comes the rebuilding phase, where the economy heals and moves forward, a testament to the strength of our Republic, Capitalism, and American commerce. It’s lovely cycle with moderate lows, modest highs and long-term growth.

But lately, the Federal Reserve has been playing a more active role, especially since 9/11. They can stretch or pinch the rubber band, even pull one end far and let it go. That’s where concern arises. Their current strategy of quantitative tightening, with rate hikes and asset sales, has stretched the rubber band too much, risking a snapback that sparks inflation.

Let’s take a simpler look at this. Consider new car sales. A whopping 91% are financed, and about 64% of vehicle owners keep their cars for five years. Interest rates play a crucial role in stimulating or dampening demand. During the pandemic, rates dropped, prompting a surge in sales till 2023. But when rates shot up, sales slowed as monthly payments grew. For instance, a $41,000 truck would cost $832/month at 9.09% compared to $734/month at 3.9%. Even $25/month makes a difference for buyers.

Increased rates lead to potential buyers being unable to afford their desired vehicles. As a result, individuals tend to hold onto their cars for longer periods instead of opting for a downgrade, mirroring the challenges seen in the housing market.

Behind the scenes, many Americans delay major purchases that require financing. This backlog grows each passing day. When Chairman Powell eventually announces a decrease in the Fed Funds Rate, it’ll signal a green light for those waiting on the sidelines. Even a small decrease could mean a significant affordability shift for buyers.

Here’s the point: If the Fed eases before reaching their 2% inflation target, it might prevent a severe inflation surge. If they’re wrong and a slight 0.125% decrease causes inflation, they can easily raise it back. But a gradual successful series of decreases would warm the markets for Treasuries, decrease national borrowing costs, and let the tension out of the rubber band nice and slow until it returns back to its original state.