Key Takeaways

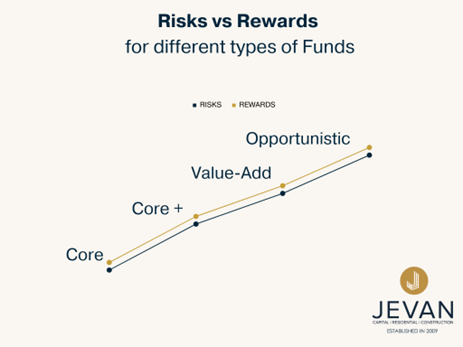

Core: Low risk, stable, moderate return, prime location and steady income

Core +: Moderate risk, balanced risk-return, minor improvements and consistent income

Value-Add: Higher risk, need to be repositioned, management intensive and higher returns

Opportunistic: Highest risk & reward, most speculative, involve development, distress or high leverage.

Core

Core +

Value-Add

Opportunistic