Key Takeaways:

- Ethical Investing: Investing in assets whose practices align with your personal mindset.

- Shift in Investment Focus: Today, many investors are acquiring assets that deliver great returns while maintaining ethical business practices.

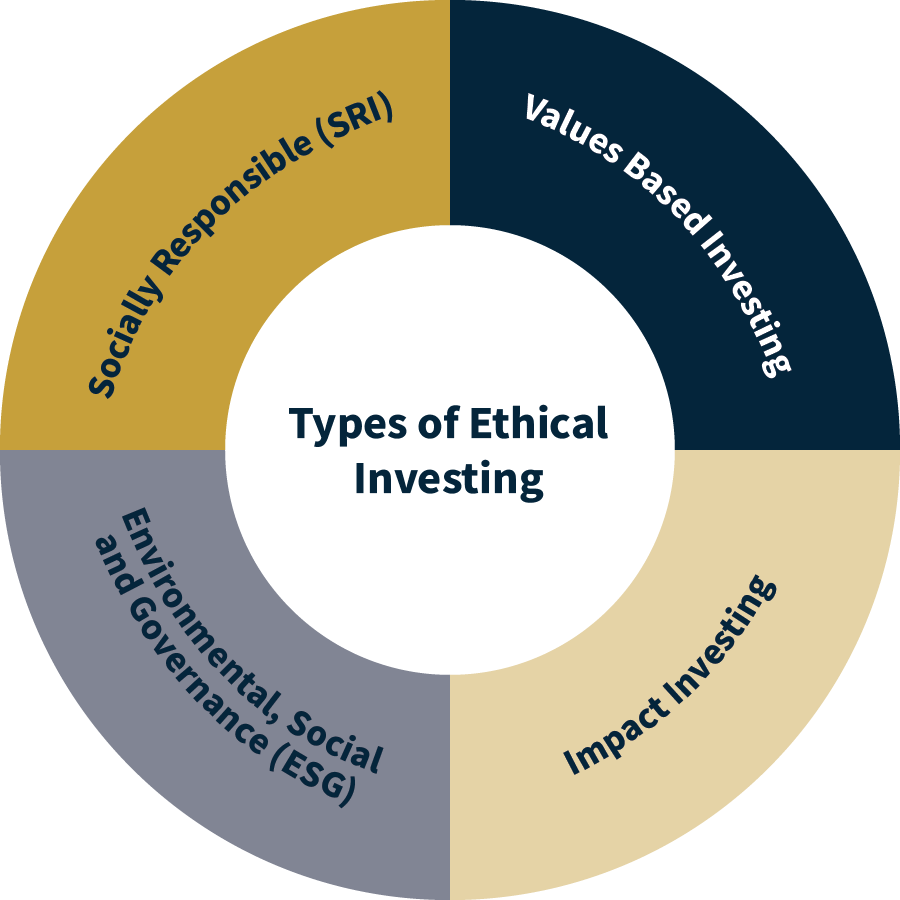

- The Four Main Types of Ethical Investing:

- Values-Based Investing: Adheres to personal convictions, spiritual, and moral principles, excluding investments that contradict those beliefs.

- Impact Investing: Seeks social or environmental benefits alongside financial returns.

- Environmental, Social, and Governance (ESG): Considers environmental and social impacts, emphasizing sustainability and transparent practices.

- Socially Responsible Investing (SRI): Avoids controversial industries like gambling, firearms, tobacco, etc.

- Advantages: Contribute tangibly to meaningful initiatives that align with your beliefs and serve as a catalyst to foster broader societal change.

- Challenges: In-depth research is required, there are performance concerns, and management can be more costly.

- These challenges, while significant, are often seen as manageable with proper consideration and understanding of the nuances of ethical investing.

Ethical investing, a multifaceted approach that intertwines financial goals with personal values, stands as a testament to a shift in investment paradigms. It’s a departure from the conventional pursuit of high returns toward a conscientious consideration of environmental, social, and governance impacts. Particularly notable is the fervent interest among younger investors, who demonstrate a pronounced inclination toward sacrificing potential returns in favor of ethical alignment within their investment portfolios.

At its core, ethical investing encompasses a spectrum of strategies, notably including Socially Responsible Investing (SRI), Environmental, Social, and Governance (ESG) criteria, Impact Investing, and Values-Based Investing. Each approach carries its unique methodology and emphasis. SRI, for instance, involves avoiding investment in certain investments that contradict one’s values. On the other hand, ESG analysis actively selects investments based on their adherence to ethical considerations, evaluating factors such as corporate governance, environmental impact, and societal responsibilities.

Contrary to earlier assumptions, the financial market has exhibited instances where ethical investments not only match but at times outperform traditional investment strategies that are solely driven by financial returns. This phenomenon challenges the conventional wisdom that ethical considerations inherently lead to diminished financial gains.

The advantages of ethical investing extend beyond financial gains. Investors often derive personal satisfaction from aligning their portfolios with their ethical principles. Moreover, these investments contribute tangibly to meaningful causes, fostering a sense of social and environmental responsibility. Additionally, ethical investing has the potential to catalyze change, influencing other companies to adopt more ethical practices as they witness the market shift toward conscious investing.

Yet, navigating the landscape of ethical investing poses its own set of challenges.. It demands extensive research and due diligence, making it a time-consuming endeavor. Moreover, there’s a lingering concern about the potential underperformance of ethical investments compared to the broader market, and the higher management fees associated with handling ethical funds.

In essence, ethical investing presents a compelling opportunity for investors to integrate their values into their financial pursuits. Yet, it requires careful consideration and a nuanced understanding of potential trade-offs between financial returns and the commitment of increased efforts in portfolio management.

Ultimately, the evolution of ethical investing represents a pivotal moment in investment strategies, blending financial objectives with a deeper societal conscience. As the financial landscape continues to evolve, ethical investing stands as a beacon, challenging traditional notions and urging investors to reassess the true value of their investments beyond mere monetary gains.